© ENNIO LEANZA/EPA-EFE/Shutterstock

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email [email protected] to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

“Come on Alphaville, you can’t use Taylor Swift to excuse yet another piece about UK inflation—” We’ll get new UK CPI inflation figures on Wednesday, which follow a drop to 2 per cent — bang on the Bank of England target — in May.

As things stand, we haven’t got that many predictions into our inbox, so we’re not here for more sellside horse-race economics journalism. Instead, we’re just going to look at Deutsche Bank. For reasons many readers will instinctively intuit, senior economist Sanjay Raja’s preview note on the upcoming print, published on Wednesday, set eyes a-twitching at FTAV towers: We have at these stage written about Taylor Swift quite a lot.

On a purely anecdotal basis, we think the pop star’s near-omnipresence in economic coverage has finally waned (though too late for some newspapers). Raja

— who expects inflation to hold at 2 per cent year-on-year — writes: One thing to keep an eye on in the June report will be recreation and culture prices. Cultural services, in particular, we think could be strong, given the Taylor Swift UK tour. And given how concert prices are collected, it will likely fall within the ONS’ price collection basket. We expect live music prices therefore to rise by around 10% – building on the 5.7% increase registered in May. Overall, we expect recreational and cultural services inflation to push up by around 1.2% m-o-m (CPI). Readers may recall we already wrote about the “pop superstar drives inflation” thing last year, in the context of Beyoncé’s Renaissance tour.

As noted back then, the Office for National Statistics was not willing to simply confirm or deny Queen Bey’s presence in its inflation figures

— that’s because the stats body doesn’t want to give away exactly where and when it observes pricing data, and which products it looks at. We speculated that Beyoncé probably wasn’t in the data, but we may never know.

Here are further pertinent points, bulleted because we never learned how to write better: — Prices for event tickets are imputed into CPI for the month when the event occurs, rather than when the ticket is bought.

— We don’t know, but we can speculate with some confidence, that the ONS prefers to monitor venues that host the same type of events every month (so that they yield comparable data). — We do know, however, that on an item level the ONS inflation data is kinda weird.

— We also know that the ONS’s agents make most of its price readings “on or around” a non-fixed day each month. We reached out to Raja, who kindly responded to our inane questions. He told us: The ONS has not quite told us what they are looking at specifically. But unlike other items in the services basket, live music events don’t seem to be contained to the so-called index collection date — which in this case we assume will be a week earlier on the 11th of June.

…So, in some way, yes, it does look like the effect of the Eras tour will be captured in the price collection data. However (and thankfully for the BoE) it will only be at the primary market (and not the secondary or resale market).

Raja reckons, based on his team’s conversations with the ONS, that the statisticians are less fussed about the precise timing of events than they are in the collection of other prices.

He told Alphaville: [If] how we have interpreted the ONS’ guidance on live music events [is right], you’d still see a strongish effect for that part of the basket.

It is small, to be sure. But it would be something akin to what we saw last year when Beyoncé rolled into town! It’s not what we were led to believe when we spoke to the ONS about this last year — and, in our view, a big part of the issue here is their refusal to offer clear guidance on these things. We can see the logic though. If date does matter, then it’s worth interrogating.

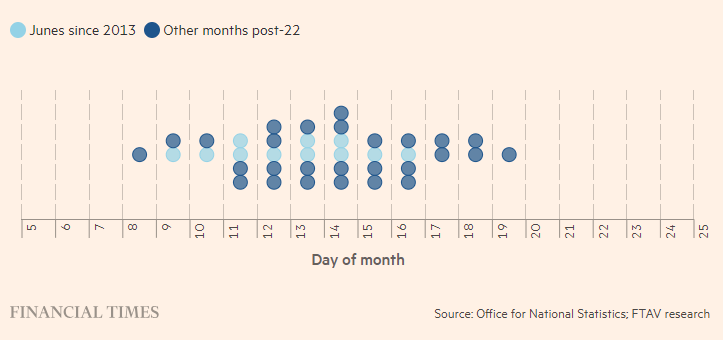

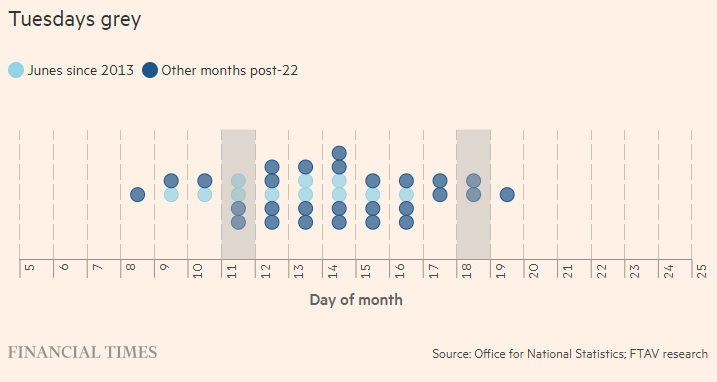

The 11th figure, Raja says, was based on an average of June collection dates for inflation data over the past decade. Let’s unpick that — here are the index collection dates for Junes since 2013, and all other months since 2022:

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email [email protected] to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

As an average since 2013, June readings have been on the 13th, while the 14th is the post-2022 average of all months. The important additional factor: collection usually occurs on a Tuesday. So, in June 2024, that makes the 11th or (less likely) the 18th the likely dates:

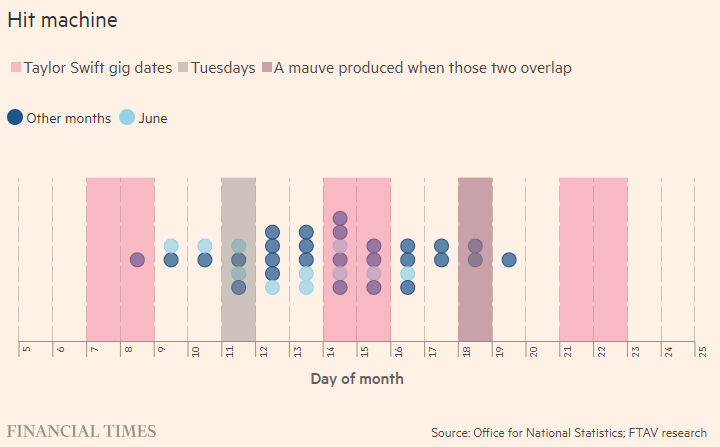

Naturally, the next thing to check is when Taylor came to town. Here are her gig dates compared with the Tuesdays:

What can we learn from this? Some observations: Observation 1: This is all unhelpful If the ONS did gather data “on or around” the 11th, it would have landed in the gap between Swift’s Edinburgh and Liverpool gigs — which would mean that Swiftflation is unlikely to show up in food or accommodation costs.

And, if they did target the collection date for ticket prices, it would mean Swift won’t have an impact there either. However, if data was collected on the 18th (which would be the latest in a decade), it’s a direct hit, you-sunk-my-battleship type situation with Swift’s appearance at Cardiff’s principality stadium, on the 18th.

Observation 2: We don’t have enough information anyway Just a date match isn’t sufficient, of course. We would also need to know that the venues where Swift appeared — Edinburgh’s BT Murrayfield, Liverpool’s Anfield, the Principality and London Wembley — are among those the ONS’s agents monitor.

And we have no way of confirming that. Can we speculate? Eh, sure. We mentioned in our Beyoncé coverage that the Renaissance venue where she performed around the collection date — Sunderland’s Stadium of Light — didn’t seem like an ideal candidate for ONS price gathering, because it does not usually host comparable (ie musical) events. Now, assuming date is relevant, and that the 18th was chosen, the situation may be different with Swift — the Principality appears to host a wide variety of events all year long.

Unfortunately, as a service, tickets aren’t one of the items for which the ONS releases detailed pricing tables, so we can’t do anything like compare prices for tickets sold in Wales to primary market Principality tickets.

So, onto our final observation: Observation 3: Bleurgh If there is a big bump in Recreation and Culture inflation, we have no doubt it will be attributed in part to Swift.

We will have no way of knowing, however, whether it was her, as opposed to all number of other things it could have been. Which is a roundabout way of saying we’ve written a thousand more words about UK inflation and we’re still no closer to being happy. Onward!

News

Larsa Pippen Drops Harsh One-Liner About Ex Marcus Jordan After Finding Out He’s Spending Time With New Instagram Model, Reveals Major Personal News Of Her Own

Larsa Pippen, Marcus Jordan, and Ashley Stevenson (Photos via Getty Images & itsashleystevenson/IG) Larsa Pippen has reacted to Marcus Jordan’s flashing a new fling with some relationship news of…

LeBron James’ daughter holds head in hands after USA Olympics legend’s ’embarrassing’ act caught on live TV feed

LeBron enjoyed his day off before Team USA’s crucial group-stage clash LOS Angeles Lakers superstar LeBron James has made his daughter Zhuri cringe with hilarious dance moves…

VIDEO: NBA Insider Shams Charania Named His GOAT, And It’s Not LeBron James Or Michael Jordan

Shams Charania (Image Source: YouTube/@TheOGsShow) Although Shams Charania specializes in breaking major news, he recently offered his opinions on the GOAT debate. During an appearance on the most…

LeBron James is caught leaving trendy Paris restaurant at 3am after hanging with Team USA’s Kevin Durant, Anthony Davis and Bam Adebayo

LeBron James and several other Team USA basketball stars were caught leaving an exclusive Paris in the early hours of Monday morning despite facing an imminent training session ahead of…

Kendall Jenner and Devin Booker risk awkward reunion as the exes attend the SAME 2024 Paris Olympics event

Kendall Jenner and Devin Booker risked bumping into each other at Thursday’s Women’s Gymnastics All-Around Final during the 2024 Paris Olympic Games. The 28-year-old model — who wore a Team USA string bikini last…

$62.6 million decision involving Steph Curry looms for Warriors ahead of 2024-25 NBA season opening night

Steph Curry contract: Warriors star could sign $62.6 million extension (SOURCE: Imagn, NBA.com) Steph Curry could make crucial decisions about his future with the Golden State Warriors. With a…

End of content

No more pages to load